Description

These are the copy methods available:

- Exact Quantity (Futures and Stocks)

This method copies the exact volume between all accounts in the group.

Example: You transmit an order for 4 contracts of ES. If your Account Group includes four accounts, each account receives 4 contracts. If your Account Group includes six accounts, each account receives 4 contracts also. - Pooled/Equal Quantity (Futures and Stocks)

This method distributes contracts equally between all accounts in the group.

Example: You transmit an order for 40 contracts of MES. If your Account Group includes four accounts, each account receives 10 contracts. If your Account Group includes six accounts, each account receives 6 contracts. - Ratio (Futures and Stocks)

You can define a ratio to each follower account from -100 to 100. If you define a 2.0 ratio and you transmit an order for 2 contracts, the follower account will receive a 4 contract order. If you define a 5.0 ratio and you transmit an order of 1 contract, the follower account will receive a 5 contracts order. Ratio values can be smaller than 1, however trades may not be copied as their quantities are not divisible by the ratio proportion. To be able to check the follower quantity Replikanto calculation result, you can use this spreadsheet. Better to use with the ATM Copy feature. - Pre Allocation (Futures and Stocks)

The quantity pre-allocated in each follower account will be used regardless of the amount of the lead order. In each leader order, an order in the follower account will be placed with the pre-defined quantity. Use in conjunction with the ATM Copy feature. - Net Liquidation (Stocks)

This method distributes shares based on the net liquidation value of each account. The system calculates ratios based on the Net Liquidation value in each account and allocates shares based on these ratios.

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with Net Liquidation values of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C. - Available Money (Stocks)

This method distributes shares based on the amount of available equity in each account. The system calculates ratios based on the Available Money in each account and allocates shares based on these ratios.

Example: You transmit an order for 700 shares of stock XYZ. The account group includes three accounts, A, B and C with available equity in the amounts of $25,000, $50,000 and $100,000 respectively. The system calculates a ratio of 1:2:4 and allocates 100 shares to Client A, 200 shares to Client B, and 400 shares to Client C. - Percentage Change (Stocks)

This method increases or decreases an already existing position. Positive percents will increase a position, negative percents will decrease a position.BUY ORDER Positive Percent Negative Percent Long Position Increases position No effect Short Position No effect Decreases position SELL ORDER Positive Percent Negative Percent Long Position No effect Decreases position Short Position Increases position No effect Example 1: Assume that three of the six accounts in this group hold long positions in stock XYZ. Client A has 100 shares, Client B has 400 shares, and Client C has 200 shares. You want to increase their holdings by 50%, so you enter “50” in the percentage field. The system calculates that your order size needs to be equal to 350 shares. It then allocates 50 shares to Client A, 200 shares to Client B, and 100 shares to Client C.

Example 2: You want to close out all long positions for three of the five accounts in a group. You create a sell order and enter “-100” in the Percentage field. The system calculates 100% of each position for every account in the group that holds a position, and sells all shares to close the positions.

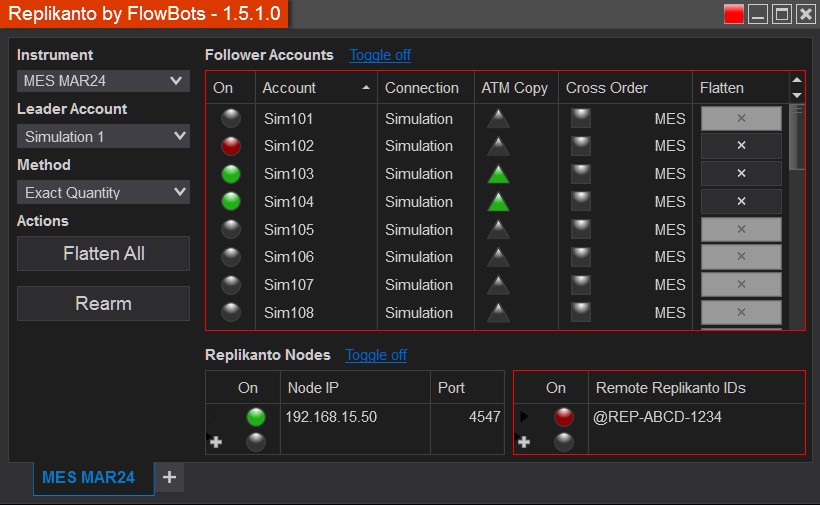

Cross Order Replikanto Instruments:

- Pre defined: ES ↔ MES, NQ ↔ MNQ, YM ↔ MYM, 6A ↔ M6A, 6B ↔ M6B, 6E ↔ M6E, 6J ↔ M6J, 6S ↔ M6S, GC ↔ MGC, ICD ↔ MICD, IJY ↔ MIJY, ISF ↔ MISF, NF ↔ MNF, RTY ↔ M2K, CL ↔ MCL, NG ↔ MNG, RB ↔ QU, HO ↔ QH, ZS ↔ XK, ZC ↔ XC, ZW ↔ XW, FDXA ↔ FDXM, HG ↔ MHG, ETH ↔ MET…

- Customize your cross order instruments at any time. How to.